This is the first entry in a series that will take a deeper look at some of the upcoming Bad Things we might suffer through during Donald Trump’s second term as President. I’ll be focusing on laying out what the President-Elect has promised, why it’s a bad idea, and what you can personally do to mitigate the damage should it come to pass.

First up: tariffs.

The Proposal(s)

It’s hard to pin down exactly what President-Elect Trump wants to accomplish with tariffs or even what tariffs he wants to impose in the first place. Here’s what the official 2024 GOP platform says:

“Our Trade deficit in goods has grown to over $1 Trillion Dollars a year. Republicans will support baseline Tariffs on Foreign-made goods, pass the Trump Reciprocal Trade Act, and respond to unfair Trading practices. As Tariffs on Foreign Producers go up, Taxes on American Workers, Families, and Businesses can come down.”

Impressively this nothing-burger of a policy proposal still manages to get something wrong, because tariffs are by definition a tax on American businesses. Hell there’s not even any numbers aside from the redundantly typed “$1 Trillion Dollars” to analyze here. To get an actual idea of what kinds of tariffs Trump wants to implement we have to look elsewhere. Judging from various campaign speeches and interviews here are three specific tariff policies I’m confident Trump wants to pursue:

Up to a 20% tariff on all imported goods

“We are going to have 10% to 20% tariffs on foreign countries that have been ripping us off for years”

Campaign rally in North Carolina, 14 August 2024

At least a 60% tariff on all imported goods from China

“You have floated a 10% tariff on all imports, and a more than 60% tariff on Chinese imports. Can I just ask you now: Is that your plan?

Trump: It may be more than that.”

Interview with TIME Magazine, 30 April 2024

Extreme retaliatory tariffs as a political weapon

“I told them, and I said it publicly, they’re not going to sell one car into the United States. I said if I run this country, if I’m going to be President of this country, I’m gonna put a 100, 200, 2000% tariff they’re not gonna sell one car into the United States.”

Interview with Economic Club of Chicago, 15 October 2024

Trump has many motivations for implementing his bold tariff plans but chief among them are classic jingoism, delusional fiscal expectations, and bad understandings of basic economics.

It is important to start with an explanation of what tariffs are, how they work, and who pays for them because the President-Elect has a habit of being very, very wrong about them. Put simply a tariff is an import tax, a surcharge the government demands before any commercial good may enter the United States. This tax is collected when a good passes through US customs and is paid by the person or business importing the good. If you’ve ever flown internationally, you are likely familiar with this paperwork that gets handed out on the plane before you land. This is Customs and Border Protection Form 6059B and is required for all persons entering the United States. You’ll notice the area of the form dedicated to a “Description of Articles” that asks for the USD value of any foreign goods a traveler is bringing with them. This is so that customs officers can calculate the required duty (aka tariff) to charge for said goods. The specific rate varies depending on the good, the country of origin, and some other factors but fundamentally a tariff is the tax you pay when you bring goods into the United States.

Crucially, the tax is paid by the person importing the goods. If you bring a $5,000 Italian handbag back from Milan, no customs agent is going to ask for the name of the boutique you got it from so they can send an invoice. At the point of taxation the American importer pays the American government in American dollars. They do accept MasterCard though, that’s nice.

Anybody who took Econ 101 could tell you that taxation isn’t so simple, costs almost always filter out into the larger economy. This is true, but in opposition to Trump’s understanding the cost of tariffs do not filter back to the country of export in any meaningful sense. Trump’s claims that China or Mexico or any foreign nation will bear the cost of U.S. tariffs are hallucinatory at best and outright lies at worst. The theoretical model for who bears the burden is rather simple, American businesses that import goods at a higher cost from tariffs will raise their sale price domestically to compensate for the loss and American consumers will pay that higher price. Some businesses on the margin will seek domestically produced goods (which still results in increased prices for consumers) or cease activity altogether (the dreaded “deadweight loss” that keeps economists up at night). The only “costs” that foreign countries could theoretically bear is the loss of income from American firms no longer buying their goods, which must necessarily also be an equivalent loss in potential tariff revenue. The Chinese factory exporting sneakers might “lose” out on a billion dollars of business, but that billion dollars isn’t going to the United States government. This right here is emblematic of the catch-22 that makes tariffs such a uniquely awful tax policy; either they raise money for the government by raising the price of goods for everyone or they don’t raise the price of goods and thus don’t make any money for the government. There’s no third option where the government makes money and prices don’t go up. The two are not just linked they’re one singular phenomenon.

Beyond not knowing how tariffs work, Trump seems to have no concept on the scale of any of the numbers he’s talking about. He has before floated the idea of scrapping the federal income tax and replacing its revenue with tariffs, including during his appearance on the Joe Rogan Experience. Let’s run through some quick numbers on what that would require.

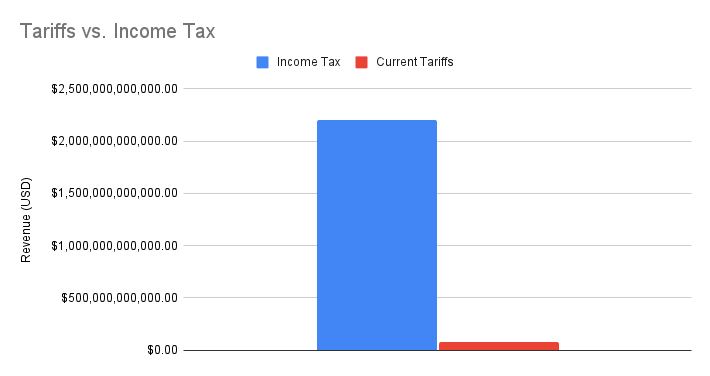

The United States federal government brought in 4.4 trillion dollars in revenue during FY 2023 (that’s Fiscal Year 2023 for you normies out there). Of that 4.4 trillion, some 2.2 trillion comes from individual income taxes, the single largest share of federal revenue. Total revenue from customs duties for FY 2023 was $80 billion. Here’s a chart to illustrate the difference.

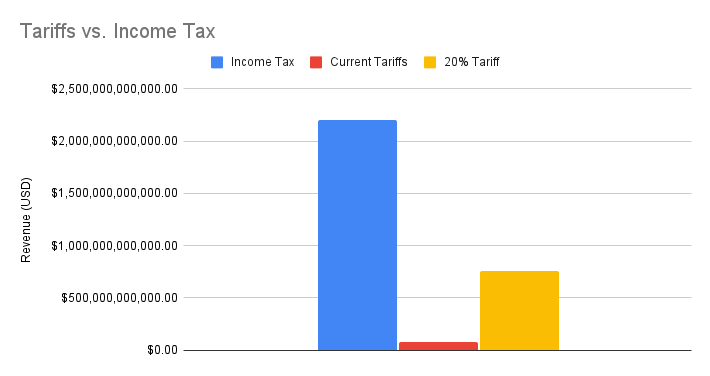

Alright well he’s gonna raise tariffs by a bunch, right? Let’s see what the payday looks like if we implement a 20% tariff on all imports. US imports for 2023 totaled $3.8 trillion. Taking 20% of that gives us $760 billion in tariff revenue. Keep in mind that this is a very generous estimate because that imports number includes both goods and services and the amount of imports would undoubtedly plummet if such tariffs were implemented, but let’s give him the best case scenario. Here’s what 20% universal tariffs gets us.

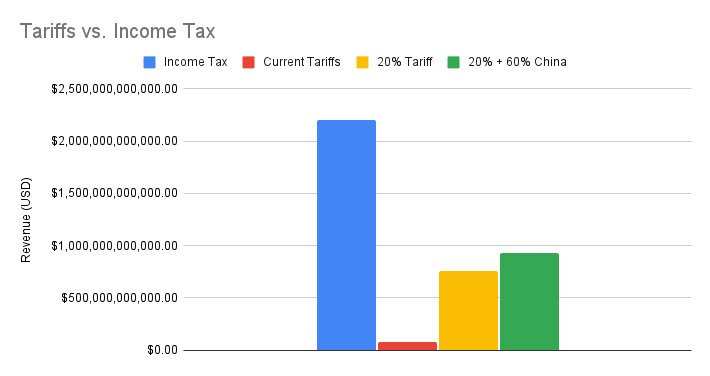

Oh. Well what about adding in that 60% Chinese tariff? The US imported $426 billion from China in 2023, so if we add 60% tariffs to all Chinese goods on top of the 20% to all non-Chinese goods and still assume absolutely zero decrease in imports surely we can get somewhere decent, right?

Huh. So what would it take to actually replace the income tax? Well if we still give him the preposterous assumption that imports would stay exactly the same no matter how steep tariffs get, it would take a 57.9% universal tariff to fully replace income tax revenue.

If Trump follows through on his promises he’ll leave a smoldering crater of at least two trillion dollars in the middle of the federal budget. That’s before knowing how the TCJA extension battle ends up going, with a potential price tag of four trillion dollars. Round of applause for the party of fiscal responsibility, everyone.

Can He Actually Do It?

Probably yeah, but it’s complicated.

Collecting tariffs (or duties) are an authority delegated to Congress in Article I, Section 8 of the Constitution. While tariffs are physically collected by Customs and Border Protection an agency under the Department of Homeland Security which in turn answers to the President, the Executive does not by itself have the authority to set what types or amounts of tariffs to collect. As with all federal bureaucracy, the real story is a bit more complicated than middle school civics though.

In 1934 President Franklin Roosevelt signed the Reciprocal Tariff Act into law, which gave the President the authority to negotiate bilateral trade agreements with foreign nations. Before this point Congress voted directly on tariff rates, but with the RTAA in place the President is authorized to increase or decrease existing rates so long as “he finds as a fact that any existing duties or other import restrictions of the United States or any foreign country are unduly burdening and restricting the foreign trade of the United States.”

Fast forward 90-odd years and the current regulatory apparatus for foreign trade is far removed from its Constitutional origins. In fact, Congress has not set tariff rates at all since the Smoot-Hawley Tariff Act of 1930. Explaining the full scope of agencies, statutes, and jurisdictions at play would likely be enough to fill multiple college classes so I’ll try my best to focus on a few key things that matter.

Section 232

Section 232 of the Trade Expansion Act of 1962 gives the President the authority to adjust tariffs on goods and their derivatives if, after an investigation by the Office of Emergency Planning, he determines “said article is being imported into the United States in such quantities or under such circumstances as to threaten to impair the national security.”

This was the authority cited by Trump when he imposed tariffs on foreign steel and aluminum in 2018. The wiggle room for what might constitute a “threat to national security” is very wide, as demonstrated by Trump’s previous tariffs on literally all foreign steel and aluminum going unchecked during his first term. Despite this, using Section 232 to justify universal tariffs on all goods is questionable. While steel and aluminum are widespread products used ubiquitously throughout the entire economy, there are at least inklings of an argument for their national security importance due to their necessity in defense manufacturing. Implementing tariffs on Brazilian coffee or Japanese figurines for military purposes requires a bit more stretching of the imagination.

Section 301

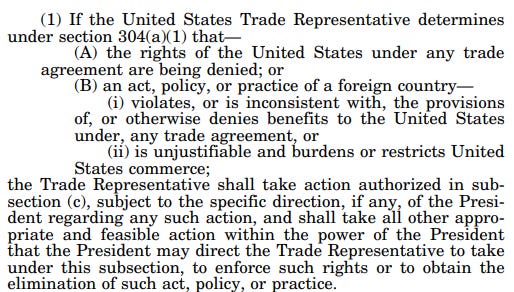

Section 301 of the Trade Act of 1974 gives authority not directly to the President but to the Office of the Trade Representative of the United States acting on behalf of the President. This authority is specifically in regards to taking action should a foreign nation violate the terms of their trade agreement(s) with the United States.

Subsection C grants authority to this Trade Representative to, among other things, “impose duties or other import restrictions on the goods of, and, notwithstanding any other provision of law, fees or restrictions on the services of, such foreign country for such time as the Trade Representative determines appropriate;”

This is the justification used by the prior Trump administration to impose tariffs on select Chinese goods in 2018. In specific, the Trump administration cited Chinese efforts to obtain and use American intellectual property as the violation to trigger Section 301. China challenged these tariffs with the World Trade Organization, claiming that they are being unfairly targeted with tariffs which would violate Article I of the WTO. President Biden left many of these tariffs in place during his administration and China’s legal disputes are still ongoing.

While the authority delegated under Section 301 is very broad it’s not necessarily a blank check Trump can use to impose whatever tariffs he likes. The original list of goods he initially placed under tariff was ostensibly a list of goods related to the accused intellectual property theft. A universal 60% tariff on any product made in China might require more justification and would likely bring even more international litigation from the WTO.

IEEPA

The International Emergency Economic Powers Act (IEEPA) is a law that grants the President some authority over economic policies in times of national emergency. This is the power that allows the President to implement sanctions against terrorist organizations or foreign adversaries, such as those placed on Russian nationals and entities following the invasion of Ukraine. Declaring a national emergency is rather easy despite what the name might suggest, the United States is technically experiencing over thirty national emergencies as we speak. During his first term in office, Trump threatened to use the IEEPA to implement up to 25% tariffs on Mexican goods in response to the emergency he declared regarding illegal immigration, though he never followed through. This strategy is likely the quickest and dirtiest method Trump could use to implement his tariffs because it only requires him to declare an emergency instead of wait for one of his federal agencies to complete an investigation like Section 232 or 301 tariffs would require.

USMCA

The US-Mexico-Canada Trade Agreement (USMCA) is a trade deal signed by President Trump on November 30th, 2018 to replace the North American Free Trade Agreement (NAFTA). The actual details of USMCA vs. NAFTA are relatively minor changes and aren’t that important to the tariff issue. What’s important is what the USMCA says about tariffs on trade between the US, Canada, and Mexico. The entire point of what was formerly NAFTA and is now the USMCA is to facilitate free trade between the party nations. It ensures low or zero tariffs on the vast majority of goods traded between the US, Canada, and Mexico. USMCA only went into effect in 2020, but since NAFTA was implemented in 1994 trade has flourished between the three party countries. A report published by the Office to the US Trade Representative in 1997 found that just three years later trade between the US, Canada, and Mexico had increased by 44% compared to 33% globally and estimates ranged from a 0.1% to 0.5% GDP increase.

While I was writing this article, President-Elect Trump threatened Canada and Mexico with 25% tariffs.

This would obviously be in violation of the terms of the USMCA, which President-Elect Trump himself signed, but it’s worse than just breaking the rules of a trade agreement. For one, it’s based on a delusional idea that Mexico or Canada are in some way responsible for the proliferation of fentanyl in the United States. Even discounting domestic production, 86% of all fentanyl smugglers are U.S. citizens, not “illegal aliens” as President-Elect Trump seems to believe. The bigger problem in my opinion is the trust it destroys in our only two neighboring countries and the precedent it sets for the future. Trade with Canada and Mexico represents some one-fourth of the United States’ total imports and exports and the status quo has been free trade for almost three decades. Tearing up that goodwill and entering an economically combative dynamic is short-sighted, stupid, and will only hurt everyone involved.

TCJA 2.0

The elephant looming in Congress for the start of President-Elect Trump’s second term is a massive budget bill. Republicans are likely to push hard for extensions to the Tax Cuts and Jobs Act (TCJA), the multi-trillion dollar tax cut that President-Elect Trump signed during his first term. This isn’t an article about how Congressional budget bills are drafted and passed so here is a highly, highly, highly simplified version. Whenever Congress changes the budget in big ways (raising taxes, cutting Social Security, whatever) they generally bundle a bunch of stuff all together into one big bill. I’ll use the original TCJA as an example. The tax cuts laid out in the TCJA on would have added roughly $6 trillion to the deficit. To offset that revenue loss, there were many other budget changes attached to the bill to lower its deficit impact. These budget changes designed to offset the cost of a main, larger change are sometimes known as “pay fors.” All in all the TCJA passed as a roughly $1.9 trillion bill, instead of the $6 trillion it began as.

Fast forward to today, and the TCJA is getting close to its expiration date next year. In order to extend the TCJA or parts of it, Republicans have to negotiate similar “pay fors” to offset an estimated price tag as high as $4 trillion. President-Elect Trump’s advisors and allies have floated the idea of using tariffs to offset TCJA extensions. Questions about whether or not that’s legally or procedurally possible aside, I think this is a particularly stupid idea. Tariffs are incredibly inefficient taxes both in terms of economic effects raising federal revenues and the prospect of raising hundreds of billions if not trillions of dollars through tariff policy would require some truly eye-watering tax hikes. Going back to the crude napkin math I did before, remember that a 20% universal tariff plus a 60% tariff on all Chinese goods wouldn’t even raise one trillion dollars of revenue and that’s before considering the inevitable economic backlash. Beyond the fact that tariffs are bad taxes, they’re also incredibly unstable. Baking tariff revenues into the cost of a decade-long budget plan is a very fragile proposition when the President can unilaterally change tariff rates and global trade conditions can change with the wind, opening the federal deficit to multi-trillion dollar swings at the stroke of a pen.

Misc.

As far as his insane plan to scrap the federal income tax, luckily that requires an act from Congress and removing $2.2 trillion from the budget would result in the mother of all reconciliations and would almost certainly never even make it to the floor. Just because he can’t actually do it doesn’t mean he should be absolved of proposing the idea. Scrapping the federal income tax is already so far down the high school libertarian rabbit hole and to suggest that tariffs could even approach replacement is hysterical. It’s absolutely insane that anyone took this moron’s economic policies seriously and anybody who unironically thinks we can replace income taxes with tariffs should be laughed back into fourth grade math class where they belong.

How Bad Would It Be?

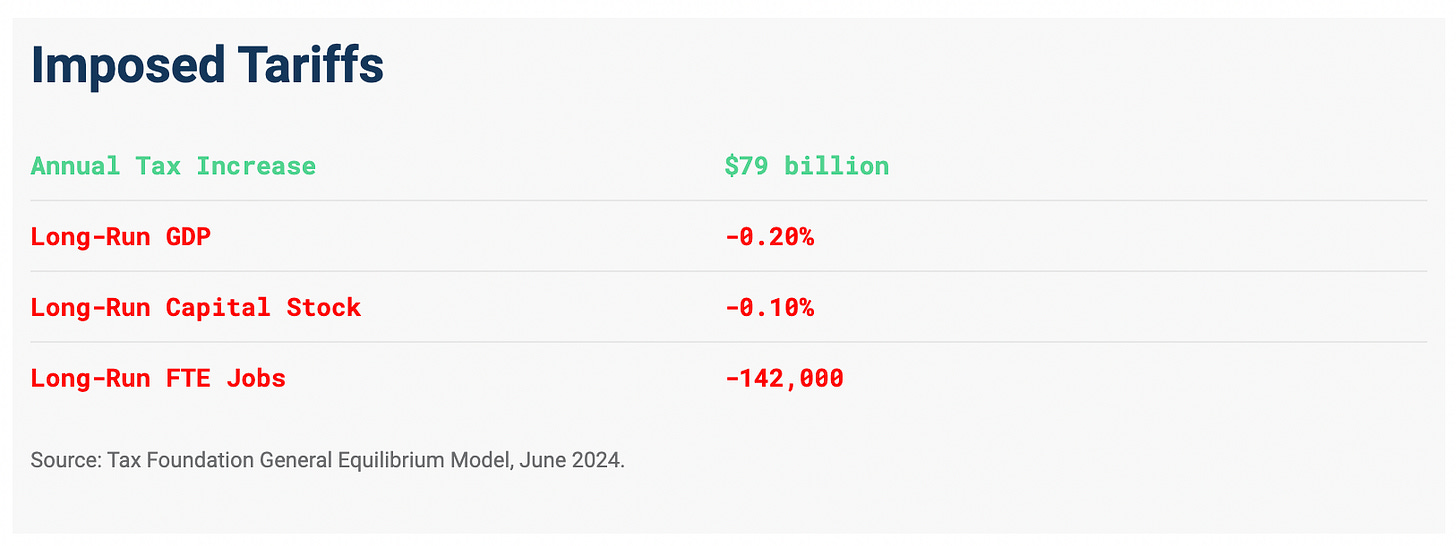

Pretty bad! Tariffs of most kinds are bad economic policy for many reasons but the size and scope of tariffs that Trump is proposing would be historically, impressively bad ideas. Before we get into predicting the future, here’s a quick look at President-Elects previous tariffs and how they turned out. I’ll be mostly working off of this Tax Foundation report tracking and estimating the effects of President-Elect Trump’s tariff policies.

As discussed before, President-Elect Trump implemented many new tariffs during his first term in office. These were in two main categories: the Section 232 tariffs on foreign steel and aluminum and the Section 301 tariffs on many Chinese goods. It’s worth noting that President Biden kept many of the Section 301 tariffs in place.

All in all, new tariffs implemented by President-Elect Trump and upheld by President Biden added an estimated $80 billion in taxes. Since these taxes are mostly paid by American consumers, that averages out to a predicted $625 tax increase per American household. In practice, the additional tax burden actually paid by American households ranges from $200 to $300 on average. Keep in mind that both of these figures only count the tax burden cost to American families and do not factor in the cost of lower employment and slower economic growth caused by tariffs.

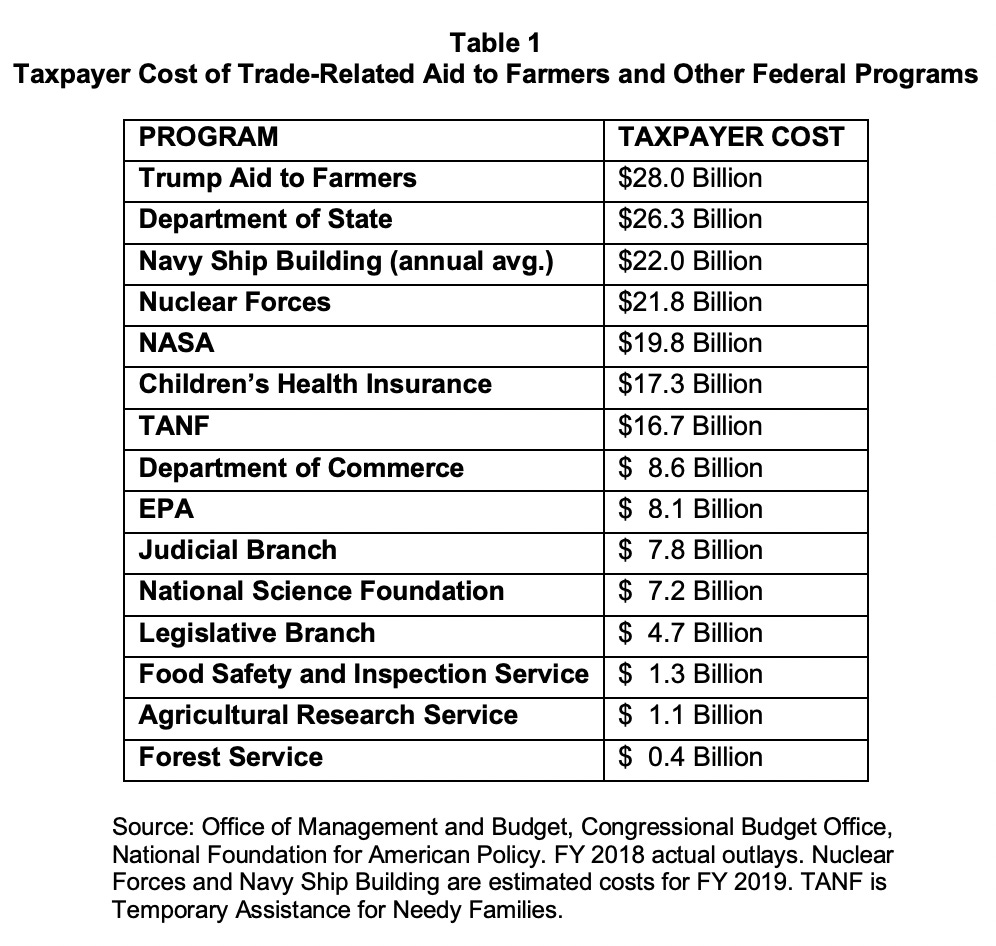

One of the most important effects of tariffs to keep in mind is retaliation from foreign countries. Despite what you may think, the United States is not the only country in the world and other people actually do have agency in this world. When the United States implements tariffs on foreign goods it almost a certainty that foreign governments will respond with tariffs of their own. During President-Elect’s first term this retaliation was felt by American agriculture. According to the National Foundation for American Policy, US soybean exports to China fell by an estimated 75% after said retaliatory tariffs were implemented. To shore up domestic political support, President-Elect Trump authorized billions of dollars of economic aid to farmers affected by the trade war. Here’s what he had to say about it during an Illinois farmer’s show:

“I sometimes see where these horrible dishonest reporters will say that ‘oh jeez, the farmers are upset … Well, they can’t be too upset, because I gave them $12 billion and I gave them $16 billion this year. . . . I hope you like me even better than you did in ’16.” -Stuart Anderson, Forbes Magazine

The National Foundation for American Policy also published a somewhat tongue-in-cheek comparison chart for how much this relief aid to American farmers cost in comparison to other government agencies and programs.

To me the worst part isn’t that President-Elect Trump spent more taxpayer dollars saving soybean farmers from his own tariffs than we do on the State Department. The worst part is that he spent nearly half of the revenue generated by tariffs on fixing the problems caused by tariffs! What’s the point of implementing these taxes if all you’re going to do with the money is hand it back out as economic relief for the tariffs themselves. Just… don’t implement the tariffs?

The Tax Foundation also has predictions for what impacts President-Elect Trump’s various promised tariffs have, and it doesn’t look very good. Based on his recently promised 25% tariff on Canadian and Mexican goods until they “fix fentanyl” the Tax Foundation predicts a decrease in GDP of 0.4% and a loss of nearly 350,000 jobs. These predictions are again before considering any retaliation from Canada or Mexico.

The economics are settled on tariffs, there is no world in which they do not bring economic harm to American families for little to no benefit. They’re one of the most inefficient taxes you can implement, they invite foreign retaliation, they barely raise revenue, and politicians end up spending most of their revenue on helping solve the problems they created in the first place. But I see a deeper problem with President-Elect Trump’s tariff obsession, completely unrelated to economics.

Tariffs are Fascist

By far the scariest thing about a second Trump presidency is the lessons he seems to have learned from his first administration. During his first term, Trump was often frustrated by the constraints of federal bureaucracy and procedure. One of the reasons he was so ineffective at accomplishing literally anything of note other than the TCJA was the fact that most of the things he wanted to do were simply impossible by the rules and procedures of the government. He wanted to “build a wall” and then found out he needed to ask Congress for the money. In response he triggered the longest government shutdown in American history, with Republicans controlling both halves of Congress, and in the end he only built some 450 miles of border wall out of the nearly 2,000 mile southern border. Many critic’s response to accusations of Trump’s fascist tendencies is “why didn’t he do fascism the first time around?” The simple answer is that he didn’t know how.

Trump had a childish view of government (like many Americans) and thought the President is “in charge” of the country. In reality the President is merely in charge of running the country by overseeing the execution of laws, policies, and agencies with decades of institutional inertia. There are certain areas in which the President has genuine personal authority to do whatever he wants, and it was in these areas that Trump had the most impact and his true political desires are revealed.

In foreign policy, Trump played a bizarre game of jump rope of both isolating the United States from her allies and the world (e.g. abandoning the Kurds or negotiating surrender to the Taliban) while also engaging in brash acts of escalatory violence (e.g. assassinating Qasem Soleimani). In immigration law enforcement, he reveled in cruel deportation policies including the separation of thousands of children from their families. When using the Presidential pardon power he pardoned a truly staggering list of questionable characters, many of which were personal friends and family. Many of these people will appear in future editions of Doomposting, so I’ll try to keep things brief.

Roger Stone: convicted on counts of obstruction of justice, making false statements, and witness tampering in relation to the Mueller investigation

Paul Manafort: plead guilty to conspiracy to defraud the United States and witness tampering in relation to the Mueller investigation

Charles Kushner: plead guilty to charges of illegal campaign contributions, tax evasion, and witness tampering. Father to Jared Kushner, Donald Trump’s son-in-law

Paul Slough, Evan Liberty, Dustin Heard and Nicholas Slatten: private military contractors convicted on charges of voluntary manslaughter and murder in relation to the Nisour Square Massacre.

Eddie Gallagher: former Navy SEAL court martialed for many accused war crimes. Described by others in his platoon as “OK with killing anything that moved” and “freaking evil”

Clint Lorance: former Army lieutenant court martialed for murder. He was notably turned in by his own soldiers.

Joe Arpaio: convicted on contempt of court in relation to civil rights lawsuits.

Whenever Trump wasn’t constrained by bureaucracy, he revealed himself to be a leader who seemingly took pleasure in displays of cruelty as strength and rewarded those who show their personal loyalty extends beyond the confines of the law. This time around he wants the rest of government to follow those same rules. Again, I’ll be writing about Donald Trump’s cabinet picks at a future date so I won’t get into the weeds right now but a main qualification for being a member of the second Trump administration is devoted loyalty to Trump himself regardless of morality or legality. I believe Trump likes tariffs so much because they are an extension of this ethos.

Tariffs allow Trump to punish entire countries he dislikes and reward those who bend the knee. The actual economic considerations are an afterthought, who cares about revenue generation or anything like that. You can see it in the way he talks about tariffs, like during his interview with the Economic Club of Chicago.

“I told them, and I said it publicly, they’re not going to sell one car into the United States. I said if I run this country, if I’m going to be President of this country, I’m gonna put a 100, 200, 2000% tariff they’re not gonna sell one car into the United States.”

Every time the interviewer asks a question about revenues or potential impacts on American importers or the long-run consequences of trade wars Trump doesn’t answer. He instead talks about how “China was paying him billions of dollars” and “these countries are going to stop ripping us off.” Tariffs, like everything with Trump, are not about actual policy outcomes but about allowing him to punish those he doesn’t like and reward those he does. Trump cares about people listening to him and doing what he says, and his obsession with tariffs is just the way he chooses to extend that personal loyalty overseas. Beyond the inevitable economic consequences, I fear for the Trump tariff plans because it’s one more step down the slippery slope of corruption. The real danger of authoritarian backsliding in the United States isn’t that Trump will wake up one day and order the arrest of every Democrat in America, it’s that he will create a political ethos in which arresting Democrats is how you get a promotion (or refusing to do so gets you fired).

What Can We Do About It?

First of all, I am not an accountant or personal finance expert and this is not anything even approaching professional financial advice. I’m just an econ undergrad with a Twitter account, don’t make any big life-changing decisions based on my Substack post. There’s not much that any of us can do to stop Trump from implementing tariffs should he want to, but that doesn’t mean things are hopeless. If Trump and Republicans push for tariffs to be used as offsets to extend the TCJA, call and email your Congressional representation and urge them to oppose such measures. Tariffs are not able to efficiently raise any level of meaningful revenues, and their ability to be changed by the Executive without warning means they are not reliable source of funding to factor into decade-long budget plans. For your personal life, if you were planning on making any big durable purchases anytime in the next couple years (e.g. new computer, new fridge, new car) and you’ve got the money now, I might consider taking advantage of this year’s holiday sales because next year’s Black Friday might look much different.

TL;DR

Tariffs are extremely inefficient taxes for generating revenue and come with a lot of economic downsides

Trump’s proposed tariffs would be historically high and still wouldn’t be enough to raise any meaningful revenue

Trump as President has many legal avenues to unilaterally implement tariffs, only constrained by his administration’s ability to massage the definitions of “national security” or “violations of American trade agreements”

Trump’s tariffs are not being used as tools of economic policy but as a weapon to coerce foreign nations into bending the knee to Trump personally